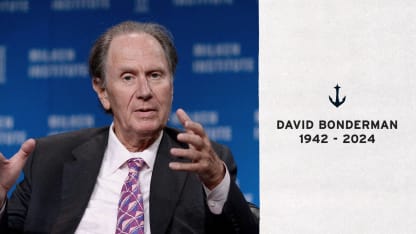

This statement is issued on behalf of the Bonderman family, TPG, Wildcat Capital Management and the Seattle Kraken.

It is with great sadness that we announce the passing of David Bonderman, the co-founder of global alternative asset management firm, TPG, and owner of the NHL’s 32nd franchise, the Seattle Kraken. David died Wednesday at the age of 82, surrounded by his family.

“Bondo,” as he was known to friends and colleagues, leaves behind a legacy marked by brilliance at every stage of his illustrious career combined with a relentless quest for knowledge and a passion for music, sports, adventure, and conservation. David was a true friend to many and, above all else, a devoted father of five and grandfather of three.

David was born in Los Angeles on November 27, 1942. He graduated Phi Beta Kappa from the University of Washington in 1963 with a major in Russian studies. While at UW, he developed both a love for the city and a curiosity about the world. He went on to Harvard Law School where he was a member of the Harvard Law Review, graduating Magna Cum Laude in 1966. While at Harvard, he was awarded a Sheldon Fellowship, which sponsored him to travel outside the United States for a year of research and discovery. He used this time to travel to Egypt and the Middle East where he studied Islamic law and became fluent in Arabic. This experience led him to create and endow the Bonderman Fellowships at his alma mater, the University of Washington, a program that has sponsored travel around the world for well over 300 students.

Following Harvard Law School, David served briefly as an assistant professor at Tulane University School of Law before moving to Washington, D.C., to be Special Assistant to the U.S. Attorney General in the Civil Rights Division from 1968 to 1969 during the administration of President Lyndon Johnson. While there, David successfully litigated many cases involving racial discrimination in the South before subsequently joining the prestigious law firm of Arnold & Porter in Washington, D.C., where he specialized in antitrust, securities law, corporate law, bankruptcy, and historic preservation. Near the end of his tenure at Arnold & Porter, David successfully represented Raymond Dirks before the U.S. Supreme Court in one of the most important insider trading cases in history, Dirks v. Securities and Exchange Commission.

It was also at Arnold & Porter that David met Robert Bass. Mr. Bass hired David to be his attorney in a dispute with the Texas Department of Transportation. After David helped resolve the case successfully, Mr. Bass asked David to move to Fort Worth to help manage his family's investment business. David reportedly told Mr. Bass, “Bob, I don’t know anything about investing,” to which Mr. Bass told him, “Neither do I, but we can figure it out together.” Never afraid to take a risk, David moved to Forth Worth to become the Chief Operating Officer of the Bass Group.